日志

Money Flows Out Of Canada 加拿大正遭遇资金流出

||

Money Flows Out Of Canada At Top Speed As Manufacturing Hits Record Low

The Huffington Post Canada

Posted: 11/02/2015 11:34 am EST Updated: 11/03/2015 11:00 am EST

Despite economists’ declarations that Canada emerged from recession in the third quarter, two new reports out Monday indicate more trouble on the horizon in the fourth quarter.

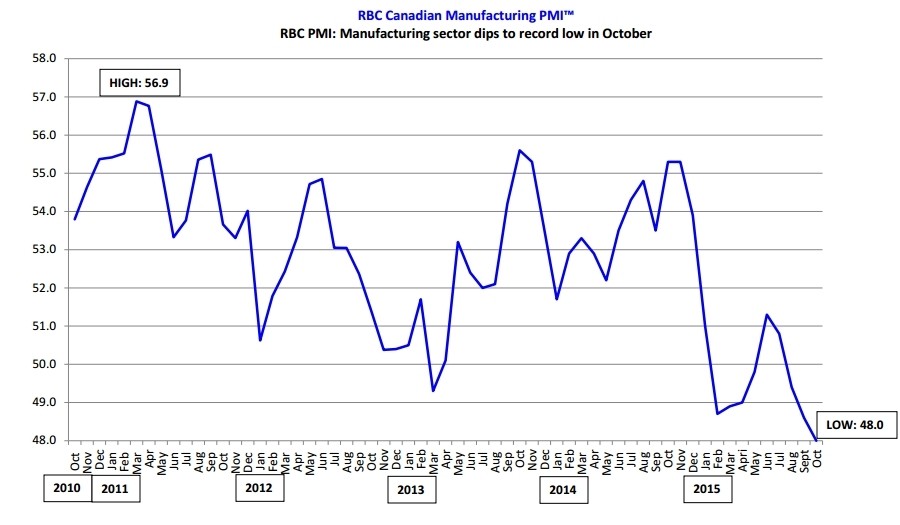

The Royal Bank of Canada’s purchasing managers’ index (PMI) hit its lowest level on record in October, pulled down by softening demand outside Canada and continuing cutbacks in the oil industry.

“Heightened global economic uncertainty and ongoing energy price weakness continues to weigh on the Canadian manufacturing sector,” RBC chief economist Craig Wright said.

Source: RBC

The index — which launched in 2010 and therefore doesn’t cover the 2008-09 financial crisis — came in at 48 in October, its lowest reading on record. Any number below 50 suggests manufacturing is shrinking.

The RBC PMI is considered a “leading indicator,” meaning that — unlike stats about unemployment or inflation — it can tell you where the economy is headed.

A measure of U.S. manufacturing activity, released Monday, shows manufacturing is doing better, but only slightly, stateside. The ISM's manufacturing index came in at 50.1 in October, down from 50.2 in September, suggesting U.S. manufacturing is barely growing.

Canadian Investors Bailing On Canada

Another leading indicator is capital investment. On that note, Bank of America Merrill Lynch had bad news for Canada Monday, with an analysis showing money is flowing out of Canada at the fastest rate of any country in the developed world.

It’s the result of a collapse in oil investment, coupled with … nothing else. That is, nothing is replacing the lost oil investment money, and investors are taking their money elsewhere.

"This is Canadian investors that are pushing money abroad," Credit Suisse foreign exchange strategist Alvise Marino told Bloomberg.

"The policy in Canada the last 10 years has greatly favored investments in energy. Now the drop in oil prices made all that investment unprofitable."

This marks a breathtaking reversal from last year. In the space of 12 months, Canada went from having an inflow of money equivalent to 4.2 per cent of its economy annually, to an outflow of money equivalent to 7.9 per cent of the economy, according to BofA/Merrill Lynch.

UPDATE 11/3/2015: A Bank of Montreal economist is disputing the numbers put forward by BofA Merrill Lynch.

"While there’s little debate the balance has deteriorated sharply over the past year, it has not been anywhere near as bad as the article states," Benjamin Reitzes wrote in a client note Tuesday.

Reitzes says the outflow of money is at 3.4 per cent of GDP currently, not 4.2 per cent as BofA had calculated. And a year earlier, it had already been negative, with money flowing out of Canada at a rate of 1.1 per cent of GDP.

"There’s no sugar-coating the deterioration, but it comes as no surprise given the drop in oil prices," Reitzes wrote.

Original story continues below.

The outflow of money means the loonie is likely to fall further as demand for the currency continues to weaken. But that’s a positive for the economy as a whole. RBC’s Wright says he expects that a falling dollar will still rescue Canadian manufacturing this year.

“A strengthening U.S. economy and weaker Canadian dollar will fuel demand for Canada’s exports, resulting in a shift to positive growth territory,” he said.

— With a file from The Canadian Press

Money flooding out of Canada at fastest pace in developed world

Demand for the Canadian dollar continues to decline. The currency already is down 11 per cent this year.

Waterloo Region Record Nov 02, 2015

Money is flooding out of Canada at the fastest pace in the developed world as the nation's decade-long oil boom comes to an end and little else looks ready to take the industry's place as an economic driver.

Canada's basic balance — a measure of national accounts that spans everything from trade to financial-market flows — swung from a surplus of 4.2 per cent of gross domestic product to a deficit of 7.9 per cent in the 12 months ending in June, according to analysis from Kamal Sharma, a foreign-exchange strategist at Bank of America Merrill Lynch. That's the fastest one-year deterioration among 10 major developed nations.

More recent data on where companies and mutual-fund investors are putting their money show the trend extended into the second half of the year, suggesting demand for the Canadian dollar and the country's assets is still ebbing. The currency is already down 11 per cent this year, after touching an 11-year low against the U.S. dollar in September.

"This is Canadian investors that are pushing money abroad," said Alvise Marino, a foreign-exchange strategist at Credit Suisse Group AG in New York. "The policy in Canada the last 10 years has greatly favoured investments in energy. Now the drop in oil prices made all that investment unprofitable."

Crude oil, among the nation's biggest exports, has collapsed to about half its 2014 peak. The slump has derailed projects this year in Canada's oilsands — one of the world's most expensive crude-producing regions. Royal Dutch Shell's decision to put its Carmon Creek drilling project on ice last week lengthened that list to 18, according to ARC Financial Corp.

Canadian companies, meanwhile, have been looking abroad for acquisitions. On Monday, Royal Bank of Canada was expected to close its $5.4 billion purchase of Los Angeles-based City National Corp., its biggest-ever takeover. It's part of a net outflow of $73 billion this year for mergers and acquisitions, both completed and announced, according to Credit Suisse data.

Nine of the 10 best-performing companies on the country's benchmark stock index in the past two years have favoured buying growth abroad rather than expanding at home.

Individuals are following suit. While international appetite for Canadian financial securities has held steady this year, domestic mutual-fund investors have pulled money from Canada-focused funds and plowed it into global choices for six straight months, the longest streak in two years, according to Investment Funds Institute of Canada data compiled by Bank of Montreal.

What it all means is the Canadian dollar has to get cheaper to make Canadian businesses outside of the oil industry competitive enough with foreign peers to make them worth investing in, according to Benjamin Reitzes, an economist at Bank of Montreal.

The median forecast among strategists surveyed by Bloomberg has the loonie weakening to $1.34 per U.S. dollar by the first three months of next year from about $1.31 now. The country's economy is expected to lag behind the U.S., its largest trading partner, for the next two years, according to the median estimate of a separate Bloomberg poll.

While manufacturing and service exports have improved thanks to the Canadian dollar's depreciation, they remain below levels from before the financial crisis, according to Royal Bank foreign-exchange strategist Elsa Lignos. That suggests the country still hasn't won back the economic capacity it lost, she wrote in an Oct. 29 note.

The country is expected to post its 12th straight merchandise trade deficit this week, according to every economist in a Bloomberg survey.

Given that the loonie was at parity with the U.S. dollar as recently as 2013, overseas companies discussing putting money into Canada may be waiting to see that the currency stays weak before investing again, according to BMO's Reitzes.

"Maybe a year from now you don't have that conversation because it's been there for a year and you have confidence it's going to stay there, so you buy that plant or make a new plant in Canada," he said. "It takes time for that currency impact to be felt."

笑话中国因果报来得快美国后院起火

当人们的目光都集中在每个月有多少资本从中国流出的时候,几乎没有人注意到全球发达国家最大规模的资本外流正在美国自家后院发生着:资金正以发达国家中最快的速度流出加拿大。

加拿大正遭遇资金流出威胁

根据美国银行Kamal Sharma的报告,截止到今年6月的12个月中,加拿大基本差额由占GDP 的4.2%盈余下滑至占GDP7.9%的赤字。基本差额由资本项目和经常项目构成,是衡量一个国家从贸易到金融-市场流动的指标。加拿大是10个主要发达国家恶化情况最快的国家。

根据Sharma的数据,彭博社这样描述道,“资金正在以发达国家中最快的速度流出加拿大。加拿大长达十年之久的石油繁荣已经结束,而现在加拿大的经济缺乏动力。”事实上,加拿大当前资本外流速度是有史以来的最快速度。

瑞信外汇策略师Alvise Marino表示,“这说明加拿大投资者正在将资金转移到国外。加拿大在过去十年的政策极大的照顾了能源领域。油价的暴跌使得所有投资的利润都打了水漂。”

资本外流加速的原因都是相似的,或者说主要都是一个原因:原油价格的暴跌。作为加拿大最主要的出口商品,油价自2014年已经下跌了一半。ARC金融公司表示,“油价的暴跌使得加拿大油砂项目出现问题。这一地区是全球原油生产最贵的地区。荷兰皇家壳牌上周决定暂缓其在加拿大的Carmon Creek油砂项目。”

更糟糕的是,油价似乎没有任何反弹的迹象,尽管目前布伦特原油价格有所企稳:

越来越多数据显示,公司和共同基金投资者的投资者正在撤出资金。市场对于加拿大元和加拿大资产的需求仍在减少。加拿大元今年已经贬值11%。加拿大元兑美元在9月触及11年来最低。

从加拿大流出的资本去了哪里?加拿大公司正在海外寻求收购机会。加拿大皇家银行周一预计将以54亿美元收购美国洛杉矶的City National集团,这是该加拿大皇家银行有史以来最大收购案。根据瑞信的数据,加拿大皇家银行今年已经完成或宣布的海外并购的净资本流出大约为730亿加元。

加拿大股市也同样反映了这一趋势。在过去两年中,加拿大股市中表现最好的10家公司中有9家都是在国外进行收购业务而不是在加拿大国内扩张业务。

加拿大的个人投资者也追随着这一趋势。

根据蒙特利尔银行加拿大投资基金数据,“尽管国际投资者对于加拿大金融证券的需求在今年保持稳定,但是加拿大国内的共同基金投资者连续六个月将资金从以加拿大为主的基金中赎出,转而投入到其他国家的基金中。这是过去两年中最长的时间。”

彭博社计算,加元越走弱,资本外流的情况就更加严重。蒙特利尔银行经济学家Benjamin Reitzes表示,加元必须继续贬值以保证加拿大石油以外行业在面对外国竞争者时的竞争优势,以吸引到投资。

两个月前加拿大经济陷入金融危机以来的首次衰退。

今天早些时候,加拿大制造业传来更多坏消息。10月加拿大RBC制造业PMI指数创历史最低值。工业产出,新订单和就业率同比都出现下降。此外,新出口销售额自4月以来首次下降,全球经济疲软已经影响到加拿大的新经济贸易。

换句话说,加拿大元的贬值已经不能帮助刺激出口了,而这原本是现代货币政策的基本定理。

根据彭博社对经济学家的调查预测,加拿大本周公布的商品贸易额将连续第12个月出现赤字。

这看上有点讽刺,之前我们还曾预测石油美元的崩溃将会削弱新兴市场国家的经济实力(这一预测已经在中国贬值人民币和2015年的新兴市场债务危机中得到部分验证)。受油价暴跌影响最大的国家既不是中国,也不是很多人预测的俄罗斯,而是拥有AAA评级的加拿大。

文章评论认为,受益于QE和美联储的低利率政策,美国页岩油行业仍然在坚持。这意味着油价仍将在低位保持一段时间。估计距离加拿大新任总理前往白宫请求奥巴马结束宽松货币政策,以帮助加拿大经济从衰退滑向经济萧条没有多久了。